Whitestein Technologies is proud to be a Platinum Sponsor to the annual...

You are here

Cognitive workflows that understand continuing regulatory compliance in the Banking Sector

Complying with ever-evolving regulations is a tremendous challenge for financial institutions. It’s not “just” tracking and complying with the myriad requirements of MiFID II, FATCA, OECD-AEoI, FinfraG, FIDLEG, PRIIPs, AIFMD, HKMA, and Dodd-Frank—though this is challenging enough. It’s the interplay between each of these sets of requirements and the need to ensure compliance and support auditability across every aspect of the institution’s operations. Also, it’s ultimately the potential risks to an institution for failing to meet regulatory expectations.

Automating workflows seems like a natural solution to the challenge of ensuring auditability and consistency of regulatory compliance. Unfortunately, the complexity of compliance makes it impossible to manage with straightforward, linear if-this, then-that style workflows. Working with clients that understand this, Whitestein has developed regulatory solutions using the Living Systems Process Suite (LSPS) that ‘understand’ the complex nature of compliance utilizing intelligent decision management.

Our regulatory solutions accommodate all mandatory and elective regulations across the jurisdictional operations of a financial organization, and provide the agility to quickly adapt and comply with regulations as they evolve. Regulations must be implemented into a range of interactions, ranging from linear to complex; the intelligent decision core of LSPS is able to coordinate and adapt the full scope of process interaction, autonomously inserting new rule and components into workflows as needed across a firm’s entire financial services landscape.

Fully integrated secure storage and management of client, mandate, portfolio, and asset data, provide financial institutions with:

- Client classification

- Risk profiling questionnaires

- Appropriateness and suitability checks

- Investment restrictions - pre- and post-trade

- Continuous portfolio health check

- Real-time analytical reporting

- Transparency and full auditability

These capabilities leverage integrated and connected third-party data sources to support a holistic approach to risk management. Risk can be assessed in terms of full KYC analysis, blacklist and background checks, investment and product suitability, and jurisdictional exposure to regulations such as MiFID2 and FATCA.

Ideally, complying with regulations should not be just about following specific rules. With LSPS, comprehensive Client Lifecycle Management and holistic risk management can help put your portfolio regulatory compliance within a wider context. You can use it to transform the knowledge arising from financial risk profile, KYC data capture, and other client history and preferences into an all-round multi-faceted digitized image of the client.

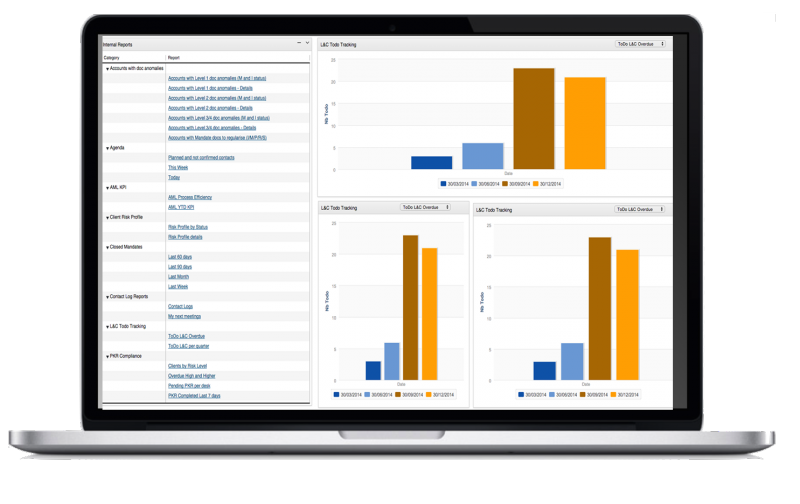

Staff benefit from this increased understanding, too. LSPS empowers knowledge workers in different roles and responsibilities--from sales and marketing to compliance officers—to understand and gain insight into regulatory goals. It provides active digital questionnaires connected to scoring systems and decision models and a holistic client profile, all in real-time and through visually compelling dashboards. With LSPS, solution users don’t just check the boxes of compliance, narrowly following procedures, but see and understand the bigger picture. This helps them to identify opportunities and risks in the moment and act to treat, or take advantage of, them.

Find out more about LSPS and how it makes it easier for financial organizations to intelligently manage regulatory requirements.